Welcome to RealtyCentral.com – The Central Resource for Online Real Estate in Southeast Florida.

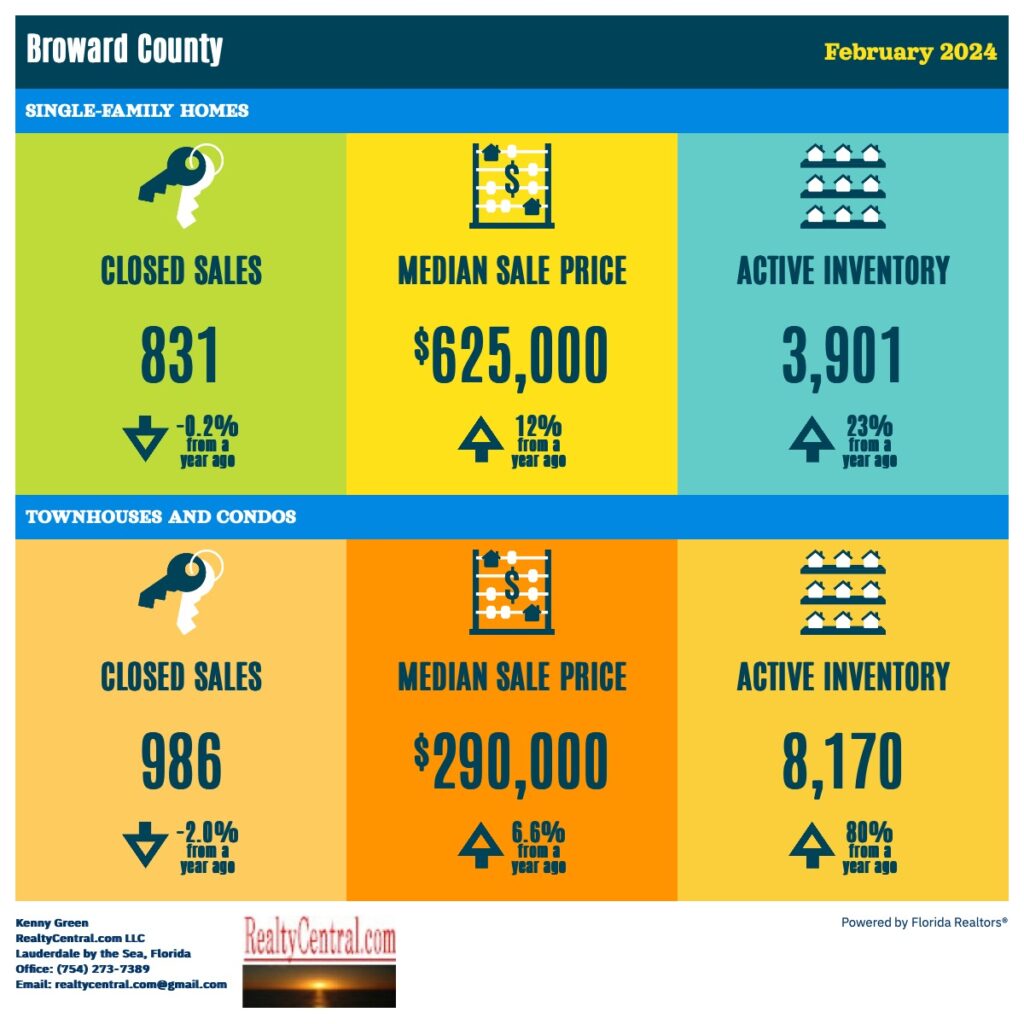

February 2024 Housing Market Conditions Summary for Broward County Florida

Real Estate Inventory for February 2024 in Broward County is up 23% year over year for Single Family and up 80% year over year for Townhouse/Condos with Median Sale Prices increasing by 12% to $625,000 for Single Family and increasing by 6.6% to $290,000 for Townhouse/Condo Sales for the same period.

BROWARD MARKET FOCUS February 2024

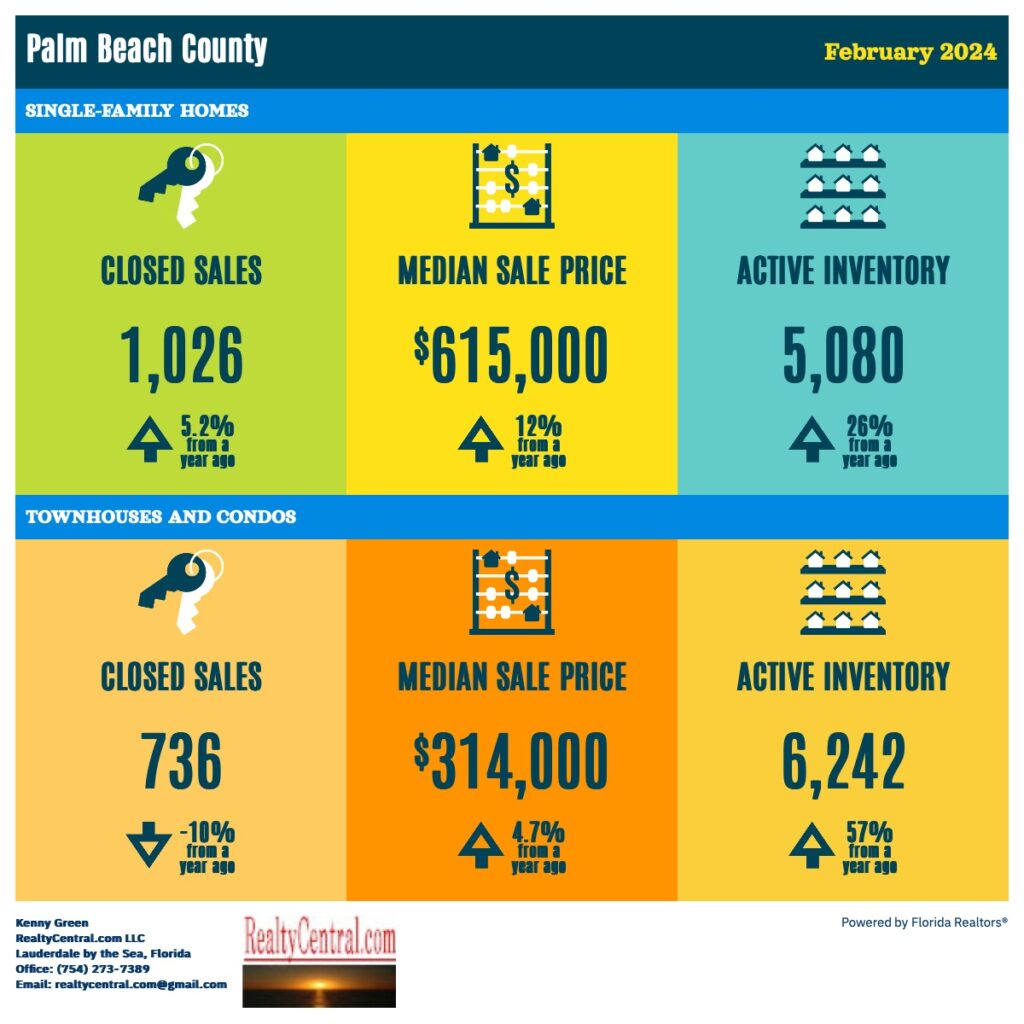

February 2024 Housing Market Conditions Summary for Palm Beach County Florida

Real Estate Inventory for February 2024 in Palm Beach County is up 26% year over year for Single Family and up 57% year over year for Townhouse/Condos with Median Sale Prices increasing by 12% to $615,000 for Single Family and increasing by 4.7% to $314,000 for Townhouse/Condo Sales for the same period.

PALM BEACH MARKET FOCUS February 2024

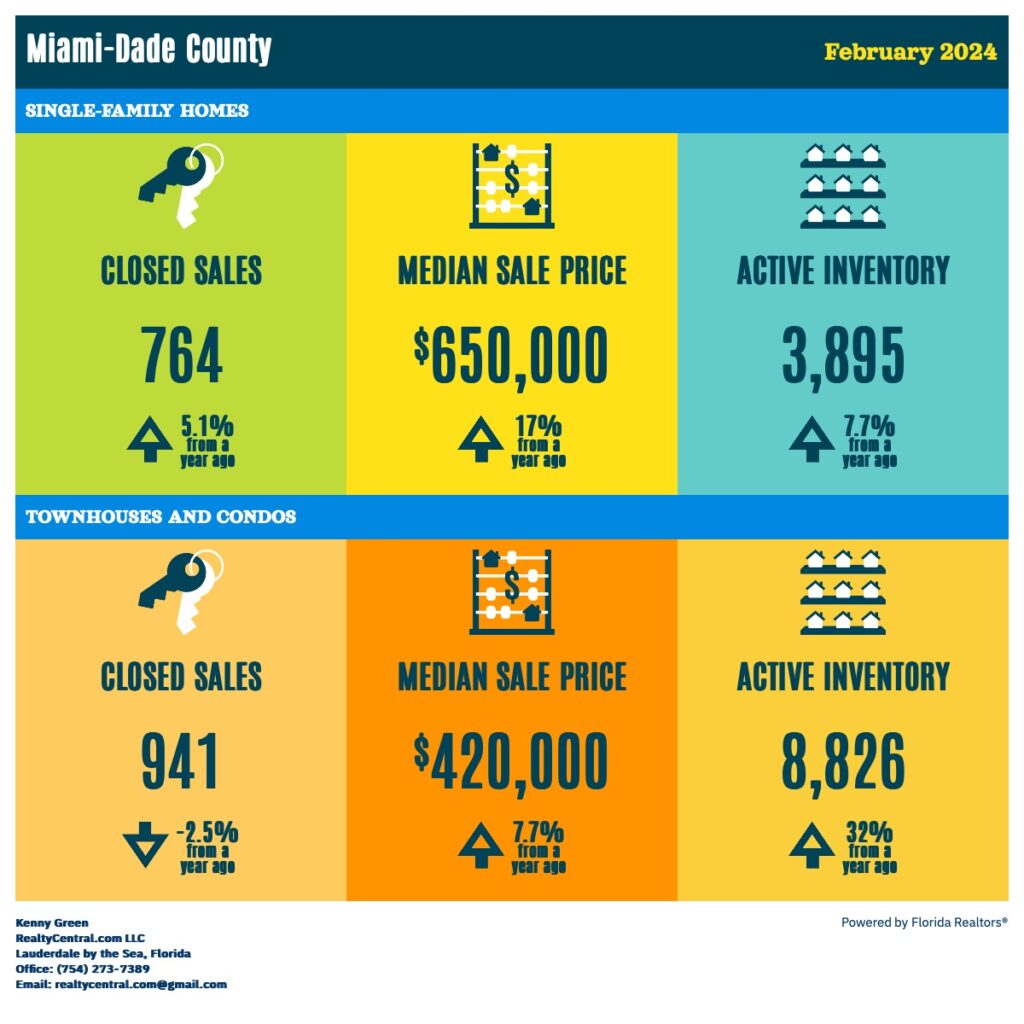

February 2024 Housing Market Conditions Summary for Miami-Dade County Florida

Real Estate Inventory for February 2024 in Miami-Dade County is up 7.7% year over year for Single Family and up 32% year over year for Townhouse/Condos with Median Sale Prices increasing by 17% to $650,000 for Single Family and increasing by 7.7% to $420,000 for Townhouse/Condo Sales for the same period.

MIAMI MARKET FOCUS February 2024