SOUTHEAST FLORIDA REAL ESTATE MARKET STATS PRESENTED BY REALTYCENTRAL.COM

May 2025 Housing Market Conditions Summary for Broward County Florida

Real Estate Inventory for May 2025 in Broward County is up 34% year over year for Single Family and up 37% year over year for Townhouse/Condos with Median Sale Prices at no change staying at $625,000 for Single Family and decreasing by 2.5% to $275,000 for Townhouse/Condo Sales for the same period.

BROWARD MARKET FOCUS May 2025

May 2025 Housing Market Conditions Summary for Palm Beach County Florida

Real Estate Inventory for May 2025 in Palm Beach County is up 25% year over year for Single Family and up 22% year over year for Townhouse/Condos with Median Sale Prices decreasing by 0.8% to $675,000 for Single Family and decreasing by 2.9% to $330,000 for Townhouse/Condo Sales for the same period.

PALM BEACH MARKET FOCUS May 2025

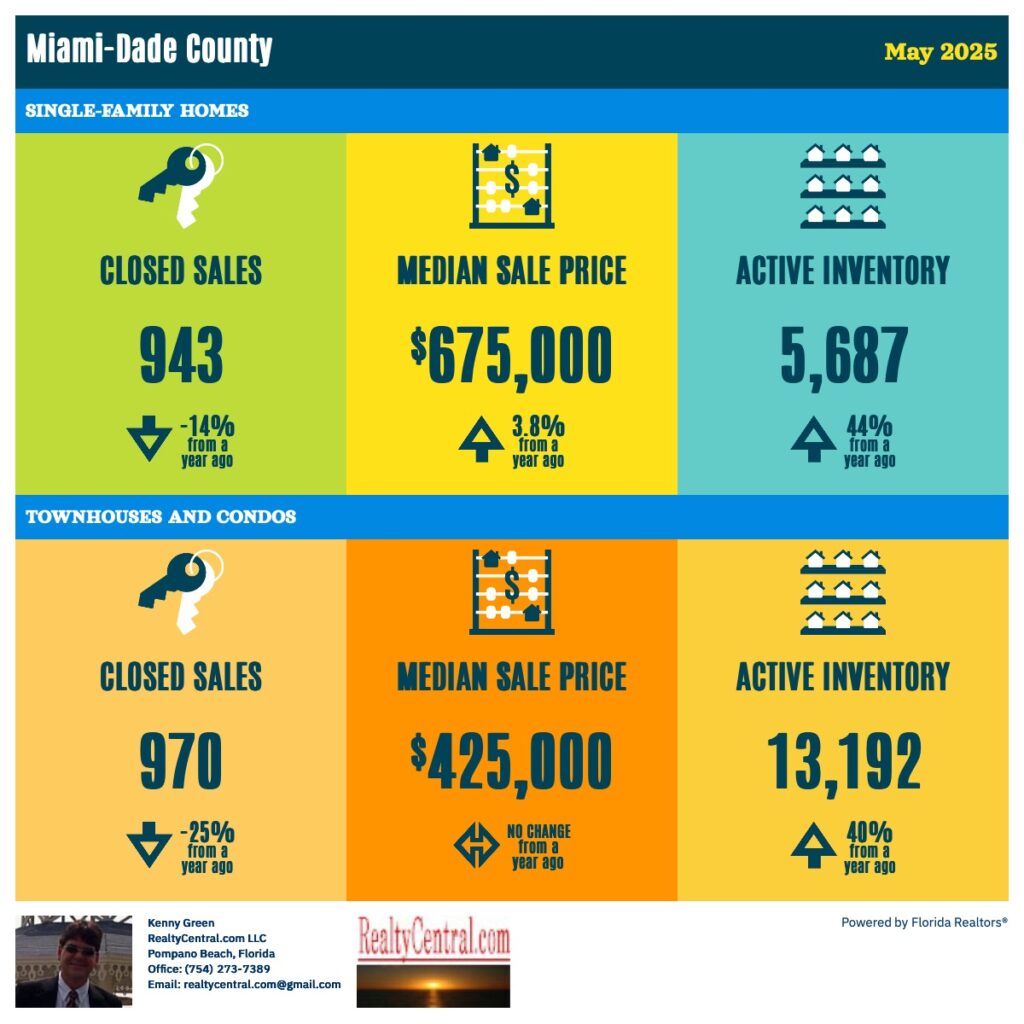

May 2025 Housing Market Conditions Summary for Miami-Dade County Florida

Real Estate Inventory for May 2025 in Palm Beach County is up 44% year over year for Single Family and up 40% year over year for Townhouse/Condos with Median Sale Prices increasing by 3.8% to $675,000 for Single Family and at no change staying at $425,000 for Townhouse/Condo Sales for the same period.

MIAMI MARKET FOCUS May 2025